Building owners can now leverage 100% financing for energy efficiency and renewable energy projects

Lebanon County, PA has now established a C-PACE program for building owners in the region to take advantage of low-cost, long-term financing for facility projects focused on energy efficiency, renewable energy projects, and water conservation.

Pennsylvania is one of 35 states, including the District of Columbia, taking advantage of the many opportunities offered by C-PACE. As of 2018, Governor Wolf signed Act 30, granting local authority to every county in Pennsylvania to establish the C-PACE program. Lebanon County, as of November 22, has joined Chester, Northampton, Allegheny, Lawrence, and Philadelphia in adopting this multi-leveled improvement program. Any Pennsylvania County can offer this expansive financing structure by simply adopting the C-PACE guidelines, in order to support building owners in funding energy and water conservation projects.

What is C-PACE?

C-PACE is a financing structure that works by providing 100% energy project financing for existing buildings and construction of commercial, industrial buildings, as well as non-profit and agricultural properties. Payments are made through an assessment on the property owner’s tax bill, and the arrangement remains with the property, even when sold. Funding is available through private investors or government programs; however, only properties located in participating areas are eligible for C-PACE financing. C-PACE can provide up to 100% financing, whereas typical financing from bank loans may cover 65-75% of the project cost.

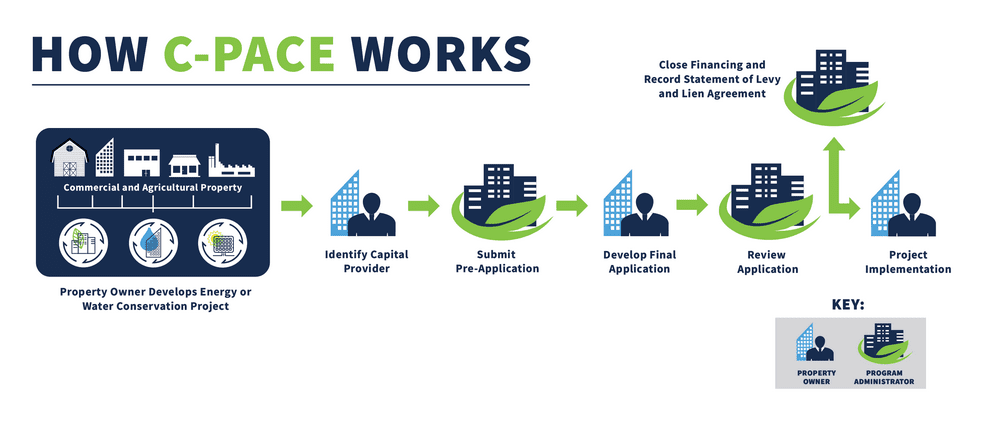

How Does C-PACE Work?

C-PACE Application Process

Step 1: C-PACE comes into play when property owner develops energy or water conservation projects

Step 2: Identify Capital Provider

Step 3:Submit pre-application

Step 4:Develop final application

Step 5: Application review

Step 6: Project implementation

Step 7: Close financing and sign record statement of levy and lien agreement

Step 1: C-PACE comes into play when property owner develops energy or water conservation projects

Step 2: Identify Capital Provider

Step 3:Submit pre-application

Step 4:Develop final application

Step 5: Application review

Step 6: Project implementation

Step 7: Close financing and sign record statement of levy and lien agreement

Benefits of Adopting the C-PACE Program for Lebanon County

C-PACE allows commercial building owners to obtain low-cost, long-term financing for energy efficient upgrades, renewable energy projects, seismic retrofits, water control measures, and even hurricane protection measures for their properties.

Counties that adopt C-PACE will experience increased business development and job creation while making buildings more resilient and increasing energy efficiency and independence. Businesses under the statute’s requirements will benefit from low-interest loans and will be able to reduce operating costs, increase property while lowering their facility’s environmental footprint.

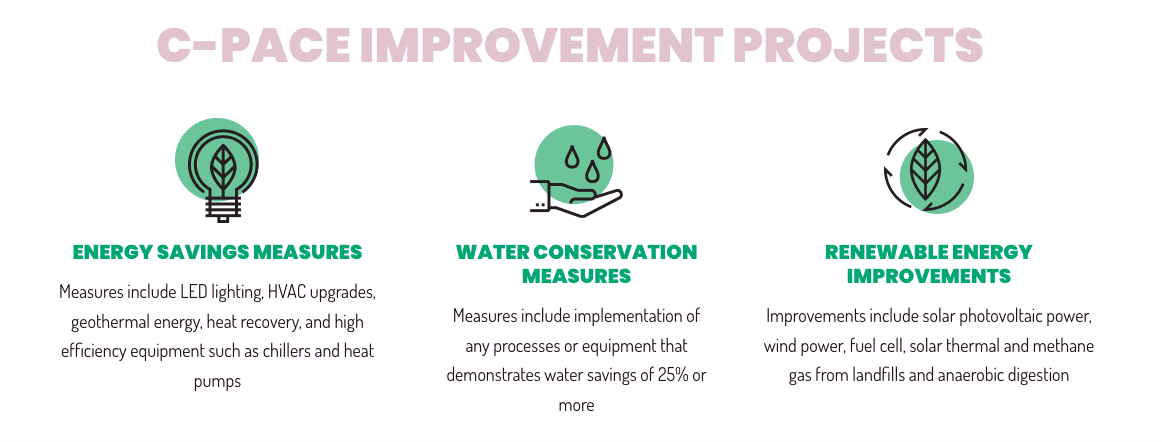

Examples of Energy Projects Financed Through C-PACE

• LED lighting and/or lighting sensors and controls

• Building automation (energy management) systems

• Heat recovery from processed air and water

• Cogeneration

• Heating ventilation air conditioning (HVAC) upgrades

• New automated building, lighting and HVAC controls

• Variable speed drives (VSDs) on motors, fans, and pumps

• Variable frequency drives, energy recovery ventilators (ERV), heat recovery ventilators (HRV), demand control devices, including energy storage systems

• High efficiency chillers

• High efficiency boilers and furnaces

• High efficiency heat pumps

• High efficiency hot water heating systems

• Geothermal energy/geoexchange

• Combustion and burner upgrades

• Heat recovery and steam traps

• Building envelope improvements, including insulation, air sealing, window retrofit, and window replacement

• Process equipment upgrades and changes

Deal structure & responsibilities for Pennsylvania counties that wish to adopt a CPACE Program

Interested parties who wish to adopt the C-PACE program for their county, can reference the C-PACE Explanation for County Officials document. The responsibilities for adopting the program include:

1) Establishment of C-PACE program through county resolution

2) Notificatiion of municipalites

3) Collection of C-PACE assessments (loan repayments)

4) Enforcement of C-PACE lien

C-PACE is a financing structure that works by providing 100% energy project financing for existing buildings and construction of commercial, industrial buildings, as well as non-profit and agricultural properties. Payments are made through an assessment on the property owner’s tax bill, and the arrangement remains with the property, even when sold. Funding is available through private investors or government programs; however, only properties located in participating areas are eligible for C-PACE financing. C-PACE can provide up to 100% financing, whereas typical financing from bank loans may cover 65-75% of the project cost.

Infographic source: Pennsylvania C-PACE

Conclusion

For more information on program development, program guidelines, and links to the pre-application, visit PennsylvaniaCPACE.org. If you have a project and would like assistance, contact A1 Energy.